Are you wondering how the Inflation Reduction Act supports investments in household energy efficiency? Learn more in this article.

What’s the IRA?

In August of this year, President Biden signed into law sweeping new climate change legislation called the Inflation Reduction Act. It funds many new investments in technologies that will help our country reduce greenhouse gas emissions, including tax credits supporting a range of Drawdown Georgia climate solutions, such as investments in household energy efficiency.

This blog post is part of a series of posts about how Georgians can utilize these new tax credits.

Making Your Home More Energy Efficient in Georgia

When we use fossil fuels to power our homes - to heat our spaces, to turn on lights, or to charge electronics - we generate greenhouse gas emissions. In Georgia, residential buildings accounted for almost 30 percent of the state’s greenhouse gas emissions in 2021.

Making homes and other buildings more energy efficient can cut back on the amount of energy used. This reduces greenhouse gas emissions and saves Georgians money. As the cliché reminds us: the cheapest, greenest energy is the energy we don’t use.

The Energy Burden in Georgia

Investing in energy efficiency is particularly important in our state, where many residents face high energy burdens.

Energy burden is the percentage of household income spent on energy. A report released by the non-profit organization Groundswell in March 2022 found that Georgia’s statewide average energy burden for low- and moderate-income households is 19.4%.

Typically, a high energy burden is above 6%, and a severe energy burden is above 10%. Energy efficiency investments that reduce household energy needs can help alleviate these burdens and help reduce emissions as well.

Cutting the Cost of Home Energy Efficiency Investments

The Inflation Reduction Act includes a series of new and extended federal tax credits as well as new rebate programs that can help lower the cost of making energy efficiency upgrades to your home.

Tax Credits vs. Rebates

Tax credits reduce the amount of money people owe in federal income tax. For example, if you owe $1,000 in federal taxes and utilize $500 in tax credits, your tax liability falls to $500. Therefore, you must owe federal taxes and wait until you file your taxes to reap the savings.

Rebates, on the other hand, directly reduce the cost of a purchase or service. Many rebates in the Inflation Reduction Act can be utilized at the point of sale, immediately lowering the purchase price. You do not need to have a tax liability to use a rebate.

Below is an overview of some of the key financial incentives included in the bill.

Energy Efficient Home Improvement Credit

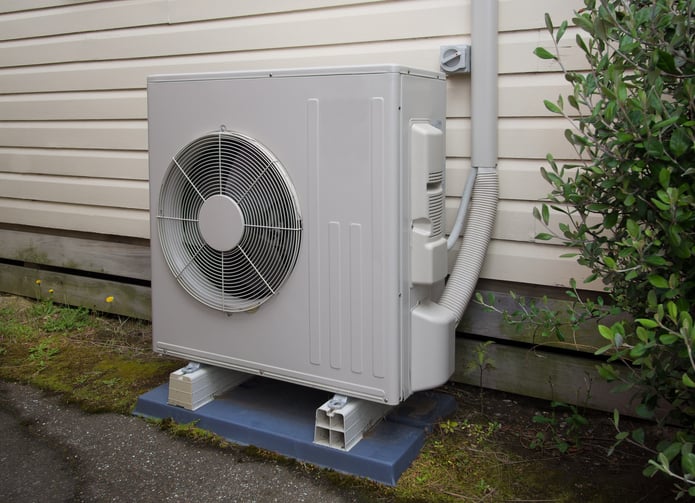

The Energy Efficient Home Improvement tax credit reduces the cost of many home improvement purchases that make your home more energy efficient, such as energy-efficient windows, doors, air conditioners, and insulation. Consumers can utilize the Energy Efficient Home Improvement Credit for some purchases made in 2022.

The full credit, which kicks in on January 1, 2023, and runs through 2032, provides savings of up to 30% of the costs for eligible home improvement purchases made each year with an annual limit of $1,200. That means consumers can utilize the tax credit year after year.

For example, it includes a tax credit of up to $600 for energy-efficient windows, central air conditioners, and electric panel upgrades; $250 for an efficient exterior door; and $150 for home energy audits. In addition, the tax credit goes up to $2,000 for qualified heat pumps. This credit is only available to homeowners.

Residential Clean Energy Credit

The Residential Clean Energy Credit supports the purchase and installation of household clean energy systems that produce electricity - like rooftop solar - or that provide home heating, like geothermal heat pumps. The Residential Clean Energy Credit allows homeowners to recoup 30% of qualified costs, with no cap on the amount that can be claimed. If the credit exceeds the homeowners’ tax liability, the savings can be rolled over into the next tax year.

The credit covers projects completed between January 1, 2022, through the end of 2032. The credit then falls to 26% for investments made in 2033 and 22% for investments made in 2034. After that, the credit expires.

The tax credit can also be used to offset the costs of home battery storage systems that have at least 3 kilowatt-hours of storage. Battery storage credits begin in 2023. This tax credit does not have income or location restrictions.

Alternative Fuel Refueling Property Credit

Georgians can now utilize federal tax credits when purchasing home charging equipment for electric vehicles. The Inflation Reduction Act revives the Alternative Fuel Refueling Property Credit, which had expired in 2021. The new credit offsets qualified costs up 30%, with a cap of $1,000. The credit runs until the end of 2032.

High-Efficiency Electric Home Rebate Program

States, including Georgia, will have access to federal funding to provide rebates to low- and middle-income families who purchase energy-efficient electric appliances for their houses and apartments. Georgia was allocated more than $109 million for this program. These rebates will be available at the point of sale up to $14,000 per household.

The rebates cover a range of purchases. For example, qualified households can receive rebates up to $8,000 for heat pumps, $840 for electric stoves, or $1,750 for a heat pump water heater.

-

Low-income households, which are defined as less than 80% of the area median income, are eligible for up to 100% of the purchase cost.

-

Middle-income households, which are defined as 80%-150% of the area median income, are eligible for up to $50% of the costs.

The rebate program could start as soon as 2023. However, the state government must establish this rebate program before Georgia consumers can take advantage of the savings.

Home Energy Performance-Based Whole-House (HOMES) Rebate

The Home Energy Performance-Based Whole-House rebate program will also run through the state government. Georgia was allocated more than $109 million for this program as well. It will provide rebates for whole-home retrofits that reduce home energy usage. To qualify for a rebate, a contractor must either perform an energy assessment to model potential energy savings or measure actual energy savings from a project.

The rebates are based on how much energy you save, whether those savings are “modeled” or “measured,” as well as household income levels. People of all income levels will be able to use the rebate program. Additional savings will be available for people in lower income brackets.

The rebate program could start as soon as 2023. However, the state government must establish this rebate program before Georgia consumers can take advantage of the savings.

How Much Could You Save from the Energy Efficiency Tax Credits?

Your ability to benefit from the new federal tax credits and rebates can vary based on where you live and your income bracket. The non-profit organization Rewiring American has created a helpful calculator to estimate how much you could save on energy efficiency tax credits as well as other incentives in the Inflation Reduction Act.

If you’re serious about improving the energy efficiency of your home while reducing greenhouse gas emissions, you may find these tax credits and rebates an ideal incentive.

Learn More About Energy Efficiency in Georgia

To learn more about how to make your home more energy efficient, check out the “How to Make Your Georgia Home Energy Efficient” toolkit authored by experts at the Southface Institute.